Consulting Services

Strengthen your lending strategies

Data-driven consulting to stay relevant and competitive in an ever-changing lending environment.

specialized lending guidance

Optimize your credit union's lending potential

Credit unions must continuously evaluate how to create efficiencies, meet evolving member needs, and increase profitability in order to maximize lending. With 30 years of experience helping credit unions excel, we can provide the guidance you need to increase productivity, elevate member service, and gain greater portfolio performance. From professional analysis and risk assessments to education, our lending advisors have the data, expertise, and industry knowledge to help you achieve your goals.

Decision engine optimization to improve speed and accuracy of loan decisions

On-site consultations to maximize utilization of our systems

Best practices to increase productivity, efficiency, and member experience

Process improvement, productivity, operational efficiency, and staff structure

Customized consultations

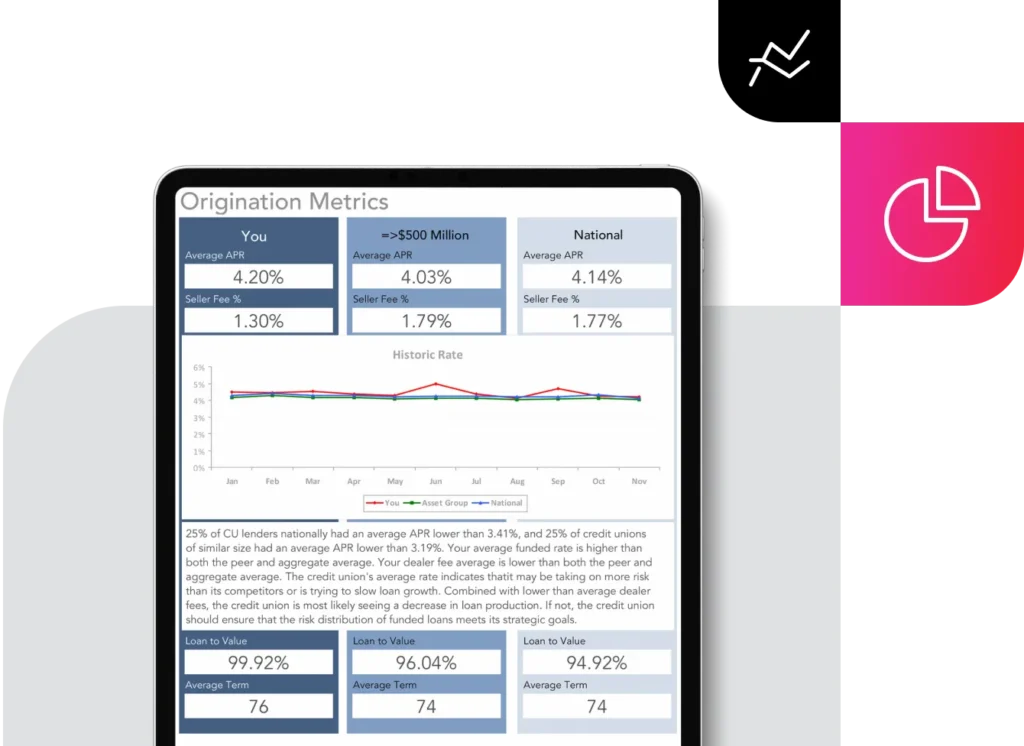

Our comprehensive suite of services includes competitive market analyses, best practices, and strategic recommendations. Leverage thorough underwriting analyses, policy reviews, dealer due diligence, and continuous monitoring. Additionally, our benchmarking against peers identifies opportunities, ensuring you stay ahead in the competitive landscape and make informed decisions for your organization.

Evaluate, review, and optimize

Loan origination process review & optimization

Enhance your lending success through extensive analysis and strategic recommendation.

Indirect lending process review & optimization

Get insight with a comprehensive analysis of your entire indirect lending process.

FTE assessment

Optimize your workforce with a full analysis of your resources and staff.

Indirect lending benchmark report

Compare your performance against peer, national, and state averages.

We're here to help.

Learn more about growing and modernizing your lending operations.

Trending content

-

State ECU Partnered with Origence and Strengthened its Indirect Lending ProgramRead more

State ECU Partnered with Origence and Strengthened its Indirect Lending ProgramRead more -

-